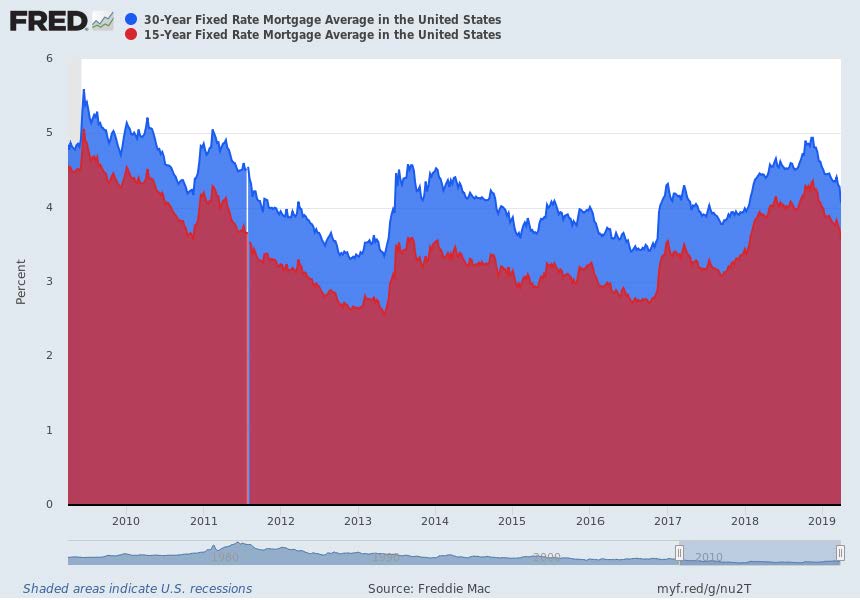

Chart of 15-Year Mortgage Fixed Rate vs. 30-Year Mortgage Fixed Rate

Thirty-year fixed rate mortgage interest rates are higher due to the simple fact that the loan is riskier for lending institutions. In addition, the borrower may be considered to be a higher credit risk, due to low credit ratings and/or low-down payments and incurring higher fees, such as, mortgage insurance premiums. Fifteen-year fixed rate mortgages have lower interest rates and potentially lower fees, as lenders consider the loan less risky due to higher monthly principle payments and the short time period related to the loan repayment.

The passing of the Tax Cuts and Jobs Act (TCJA) changed the tax laws related to the mortgage interest expense deductions. Though mortgage interest expense may still be deductible, the once lucrative tax break for mortgage interest may no longer be relevant to most tax payers. Now in order to qualify to itemized deductions, including mortgage interest, the itemized deductions now need to be greater than the new higher standard deduction.

Obviously, one pays less interest on a 15-year mortgage than a 30-year mortgage during the term of the loan; but with either mortgage term, a great way to mitigate the potential loss of the mortgage interest deduction is to lower the mortgage interest expense by simply making additional principle payments on a monthly basis. By making voluntary additional monthly principle payments, both interest expense and the principle will be reduced. An added measure of security for the borrower is they can always go back to making their standard monthly mortgage payment if personal finances become tight.