Are Spreadsheets Running Your Business?

By Daniel R. Siburg, CPA, CVA

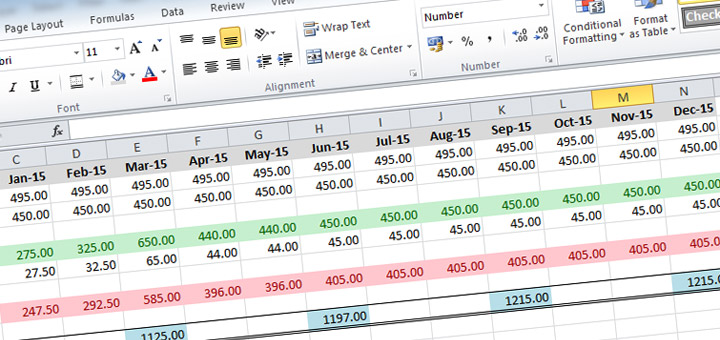

Businesses need spreadsheets and make widespread use of them. Spreadsheets increase the ease and convenience of analyzing operating information, employee data, forecasts of financial results, or just about any other type of business data. They are an incomparable tool for analyzing numeric and alphabetical data. Some companies, however, overuse spreadsheets without understanding the risks of depending on them for tasks they were not designed to handle.

The primary benefits of spreadsheets are that they sort, crunch, and arrange data according to criteria set by the user. And, the user can change the parameters at any time without losing any of the data. In addition, businesses can import data to a spreadsheet that has been exported from other software programs. Then all that data can be manipulated and analyzed in a spreadsheet or arranged in groups of spreadsheets that can be consolidated into one spreadsheet. Or, data from a master spreadsheet can be parsed into numerous spreadsheets or data from various spreadsheets can be linked together to provide management reports, consolidate budgets, or analyze sales versus inventory. The application of spreadsheets, in terms of arranging data, is limitless. Businesses run into the limits of spreadsheets when they over use them as the main source of data processing or as a short-cut to management reporting versus finding other management software that will serve the business more efficiently and thoroughly.

Use Application Software

Ask a business manager if he uses spreadsheets to process employee payroll, and most likely, he will say

that the company uses an outside payroll service that is available in today’s marketplace. However, if you

ask a business manager how the company utilizes spreadsheets, you will hear a long list and that list will

mention tasks that spreadsheets were not designed to handle, such as sales rep commission reports,

royalty payments to authors or special financial reports. And the truth is, he should be using application

software designed to handle tasks specific to his business, but uses spreadsheets instead. In the grown-up

world of business, there is application software designed specifically for publishers, distributors, manufacturing companies, professional services firms, and the list goes on. But many companies, instead of spending for application software, develop spreadsheets to help handle every task within every level of the company. The problem is that these spreadsheet systems are designed for broad and wide-ranging use

for presenting large and various sets of information in an easy-to-read format versus solving the company’s operational problems related to data and information management.

Further, spreadsheet development is the brainchild of a single person. Companies often forget to give proper consideration to managing spreadsheet usage for risk. For example, if only one person is producing these vital spreadsheets, is their knowledge of the business thorough enough to understand the information they are processing and how it will be used by management? Worse, what if designer of the

master spreadsheet leaves the company? Moreover, what checks and balances are in place to make sure that formulas are calculating correctly?

In short, if your company is going to or is now processing large amounts of data outside your core

application software, management needs to consider getting application software that will be able to

provide the management reporting and data management that is specific to the business.

View Source Documents

Management reporting is often provided in a spreadsheet format that is pretty and easy to read but that lack the actual source documents from which the data was derived. Business management and owners should be reviewing and looking at source documents at the same time they receive their management reporting package in spreadsheet format.

Chief executive officers, chief financial officers, and chief operating officers should take extra special care in comparing source documents to their management reporting package in spreadsheet format, which provides them a step to reduce potential embezzlements or fraud within the organization. A very simple procedure would be to compare the sub-ledger to its related general ledger account to make sure the two

are in balance. If the general ledger is out of balance with the sub-ledger then the source of the problem needs to be identified and corrected immediately.

Management should also consider looking at source payroll information versus management-reporting package in spreadsheet format to insure that employee pay rates and other information is correct versus just looking at the summarized payroll amounts on the financial statements. In other words, management needs to verify and spot check information on a regular basis, such at every month-end close, to make sure that the sub-ledgers and general ledger tie out and make sure that payroll figures tie out to the payroll records.

Conclusion

For business, spreadsheets are the right tool for data analysis and should continue to be used for that purpose. It is management’s responsibility to use spreadsheets as the right tool, for the right job, at the right time, and avoid over using spreadsheets for every business-data analysis need and reporting situation. In addition, there is no situation that a spreadsheet can take the place of a source document. So, the next time you look at a spreadsheet, ask yourself if the company needs to have better application software to replace all the home-grown spreadsheets that are running the business.

The Siburg Company, LLC is a boutique consulting firm specializing in the areas of financial and operational consulting, business development, and mergers and acquisitions.

We invite you to call us to discuss your current business needs or to schedule a future appointment.

The Siburg Company, LLC

Phone 480.502.2800

Fax 480.502.2804

Recent Comments