A Publisher’s Cash Management Plan – Part 1 – Managing Your Cash Flow

Part 1—Managing Your Cash Flow

By Daniel R. Siburg, CPA, CVA & Howard W. Fisher

The growth and survival of your business depends on active management of one asset—cash. The simplest cash control is the mantra “Never overspend!”

However, many moving pieces are involved in managing cash and we are going to cover the major components in this and subsequent articles.

Actively managing your company’s cash in-flows and out-flows allows you to meet routine financial obligations, purchase equipment and grow your business with liquidity. Cash management is a combination of using cash controls; managing accounts receivable, royalty advances, production costs, inventory purchasing and levels, payroll and payroll taxes, and accounts payable; maintaining lines of credit, and knowing when to purchase capital assets.

Good cash management is exceptionally important for publishing companies because they face double jeopardy—slow payment from wholesalers and “payment” in the form of returns by many accounts.

Cash Controls

Here are three of the most important cash controls you can put in place:

Use Purchase Orders and Signature Authority

Stop the expense before it actually happens. Let employees know what their signature authorization level is before they start purchasing items for the company. Control expenses and authorization levels with a purchase order system that provides documentation to management and a forecast of cash needs for all purchasing activities.

Limit Check-Signing Power

The owner or President should sign all checks. The process of signing checks gives you a much better idea of what, when, where and how the company is spending its money. The person who signs checks should be the last review and control of a cash management out-flow process.

Don’t use corporate credit cards

Employees should use their personal credit cards for business-related expenses and submit the expenses for reimbursement through expense reports. If some employees need cash advances, your pre-approval of the expense gives you even more management control.

These simple cash controls will help everyone in the company remember that cash is the resource that supports all the company’s activities.

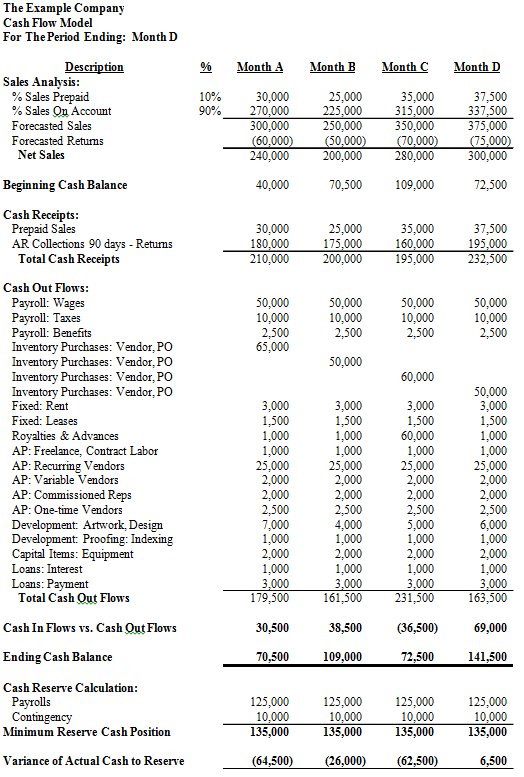

The Basic Cash Flow Model

A monthly cash flow model is the major tool for running your company. The monthly model works especially well when you pay invoices monthly. Weekly models become too detailed to maintain. Yearly models provide no help.

Once you build a monthly cash flow model that shows how your company operates, your accounting department can maintain it. (And don’t think you can get by with just your Accounts Payable aging!)

Cash-in

The top section of your model will use your sales and returns figures forecasted according to your company’s experience curve for cash sales and sales on account. The section below will track actual sales and returns.

Generally publishers collect Accounts Receivable at least 90-120 days after sale less returns. An active AR collections process is necessary. If you use a distributor, you may have a relatively close estimate of your projected cash receipts, but you’ll have to take account of the fact that the current month’s returns are deducted before payment.

Cash-out

Sections used to help evaluate cash-out are generally placed in order of payment priority. Enter payments in the months when they occur, not necessarily when the expense was or will be incurred on the P&L. Subtotal each section below.

Payroll, payroll taxes, employee benefits. This is your first section because these expenses must be paid. Payroll is a controllable cost. Hire new employees as a last resort because a payroll expense never goes away. Note that employer benefits and taxes will be at least 25% more than the base payroll amount.

We always recommend using a national payroll service, even for just one employee. It is a small price to pay to ensure all your payroll taxes are handled in a correct and timely way. Always maintain a reserve in cash equal to two months of payroll and payroll taxes. A reminder: Corporate officers are personally liable for unpaid payroll taxes.

Inventory purchases. All inventory purchase orders must be entered. Detail these here or as a separate worksheet with line items for each purchase with vendor, PO, expected dollar amount and schedule in the appropriate month by due date. Selling inventory is what generates margin and that is what pays all of the rest of the bills. Ensure that regular sellers are in stock at all times. Keep a balanced inventory even at the expense of slightly higher unit costs.

Fixed expenses and scheduled payments. These include rent, mortgage, leases, notes, etc. Place them in the schedule in the appropriate month.

Royalties and Advances. Estimate future royalty payments based on your sales forecasts and royalty percentage experience. You should already know your expected royalty payments total at least six months ahead. Detail advances by title with payments in the proper month.

Accounts payable. Break these down into subsections: Freelance/contract labor, Regular vendors, Variable and One-time vendors. Assume that most general operating costs will be paid in the same month they’re incurred. Adjust vendor payment as appropriate from historical experience, trending and planned changes to operations.

Book development costs. Whether you include these in the accounts payable area or put them in a separate section, make sure they are included in your cash forecast model. Use the costs from your title P&Ls with timings to match the production schedule.

Capital assets. Enter planned equipment purchases and major repairs or improvements to equipment and facilities here.

Credit line. If you have a line of credit or are using asset-based lending, you’ll need another worksheet sub-schedule to calculate monthly interest, loan repayments, draws and the timings involved. Then schedule these payments into the appropriate month.

Calculate

There you have it! All of your inflows and outflows in one place. Project all categories in detail three to six months ahead. This way you will always have a rolling cash flow picture. When you are comfortable that it is working correctly stretch it to 12 months.

Using your beginning cash balance, calculate future month-by-month cash balances to identify projected pinches. You can do something about those pinches today—not after you’ve purchased too much inventory, failed to collect your AR, or let recurring expenses go on too long.

The beauty in establishing your own model is that you promptly gain a better understanding of the moving parts of your business in terms of total cash.

Your monthly cash flow is now your company’s #1 survival tool and will reveal operating problems, sometimes months before you could discover them in the P&L. Using the cash flow model in combination with the P&L and balance sheet will become the real test of your business model.

Implement

Update your monthly cash flow completely before paying invoices, remembering to keep your set minimum cash balance to cover payrolls and other contingencies. This will allow you to make adjustments in amounts or timing of vendor payments to fit cash availability. Rework your cash flow until it works. Then pay your bills. (Still in a pinch? Pay everyone something every month.)

Develop the discipline of paying 90% or more of your bills at the same time each month. Limit other weekly check runs to freight and expense reimbursements on the same day each week. Stick to your schedule and you will rarely have a check request that cannot be scheduled.

Dealing with real-life cash flow dilemmas is easier when you use a cash flow model because you can test the cash outcomes of alternative choices immediately. Can you afford to hire? Should you print more or less? Can you repay your loan? What additional working capital will you need?

In future articles in this series we’ll discuss tools for accounts receivable management, asset-based lending, inventory purchasing systems and more.

We invite you to contact us.

The Siburg Company, LLC

Phone 480.502.2800

Fax 480.502.2804

Recent Comments