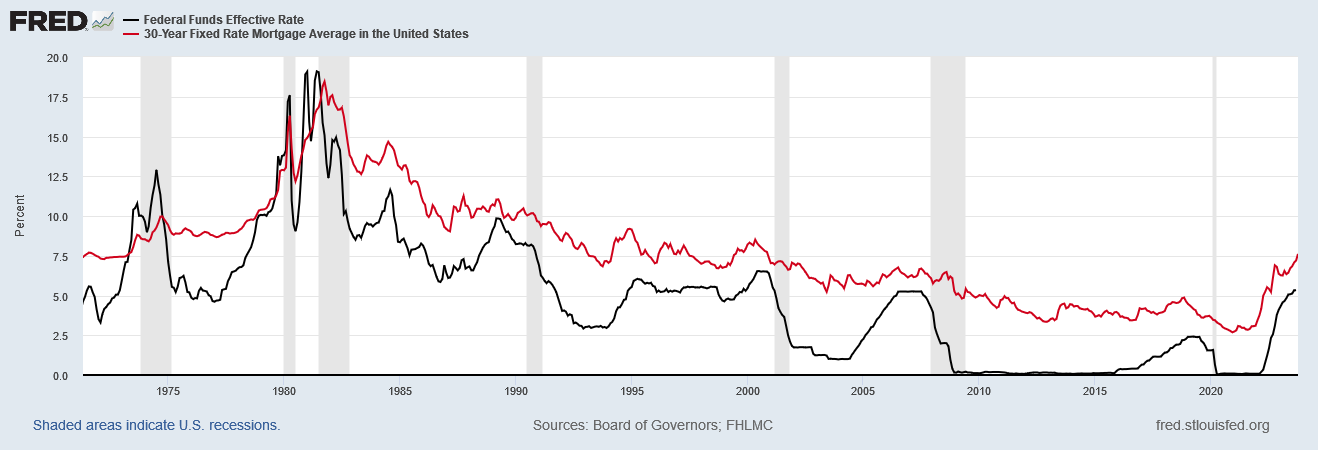

Chart of FED Fund Rate and 30-Year Fixed Mortgage Averages in United States

The graph shows the spread between the Federal Funds Effective Rate and 30-Year Fixed Rate Mortgage Average in the United States. The Federal Funds Rate is the central interest rate in the U.S. financial markets. The Federal Reserve decisions related to Federal Funds Rate plays a role in mortgage interest rates, but its actions only indirectly affect mortgage rates. Mortgage rates are set by various lending institutions. Few people with existing mortgages are actually paying the current mortgage rates. Homeowners that have existing mortgages have lower rates, than those currently getting mortgages.

Please note this chart requires the following Freddie Mac disclosure: Data is provided “as is,” with no warranties of any kind, express or implied, including, but not limited to, warranties of accuracy or implied warranties of merchantability or fitness for a particular purpose. Use of the data is at the user’s sole risk. In no event will Freddie Mac be liable for any damages arising out of or related to the data, including, but not limited to direct, indirect, incidental, special, consequential, or punitive damages, whether under a contract, tort, or any other theory of liability, even if Freddie Mac is aware of the possibility of such damages.

Please contact The Siburg Company anytime to discuss your business’s strategic plans.

The Siburg Company specializes in sell-side and buy-side mergers and acquisitions, and M&A advisory services.